Loading AI tools

From Wikipedia, the free encyclopedia

The economy of Austria is a highly developed social market economy, with the country being one of the fourteen richest in the world in terms of GDP (gross domestic product) per capita.[19] Until the 1980s, many of Austria's largest industry firms were nationalised. In recent years, privatisation has reduced state holdings to a level comparable to other European economies. Among OECD nations, Austria has a highly efficient and strong social security system; social expenditure stood at roughly 29.4% of GDP.[20][21][22]

This article needs additional citations for verification. (September 2009) |

| |

| Currency | Euro (EUR, €) |

|---|---|

| Calendar year | |

Trade organisations | EU, WTO, OECD |

Country group | |

| Statistics | |

| Population | 9 179 693 (July 1st 2024) [3] |

| GDP | |

| GDP rank | |

GDP growth |

|

GDP per capita | |

GDP per capita rank | |

GDP by sector |

|

| |

Population below poverty line | 17.7% at risk of poverty or social exclusion (AROPE 2023)[6] |

| 28.1 low (2023)[7] | |

| 71 out of 100 points (2023)[9] (20th) | |

Labour force | |

Labour force by occupation |

|

| Unemployment | |

Average gross salary | €3,050 monthly (2021)[14] |

| €2,224 monthly (2021)[14] | |

Main industries | construction, machinery, vehicles and parts, food, metals, chemicals, lumber and paper, electronics, tourism |

| External | |

| Exports | $156.7 billion (2017 est.)[5] |

Export goods | machinery and equipment, motor vehicles and parts, manufactured goods, chemicals, iron and steel, foodstuffs |

Main export partners |

|

| Imports | $158.1 billion (2017 est.)[5] |

Import goods | machinery and equipment, motor vehicles, chemicals, metal goods, oil and oil products, natural gas; foodstuffs |

Main import partners |

|

FDI stock | |

| $7.859 billion (2017 est.)[5] | |

Gross external debt | $630.8 billion (31 December 2017)[5] |

| Public finances | |

| Revenues | 49.0% of GDP (2019)[15] |

| Expenses | 48.2% of GDP (2019)[15] |

| Economic aid |

|

| |

| $21.57 billion (31 December 2017 est.)[5] | |

All values, unless otherwise stated, are in US dollars. | |

Labor movements are particularly strong in Austria, and they have a large influence on labor politics. Next to a highly developed industry, international tourism is the most important part of the national economy. The economy of Austria's average GDP is 13th growth in OECD countries, from 1992 to 2017. In Austria, 1.37% over average population growth is the strong factor.

Germany has historically been the main trading partner of Austria, making the Austrian economy vulnerable to rapid changes in the German economy.[23] However, since Austria became a member state of the European Union, it has gained closer ties to other European Union economies. This development reduced its economic dependence on Germany. In addition, Austria's membership in the EU has drawn an influx of foreign investors.

They were attracted by Austria's access to the European Single Market and the country's proximity to the aspiring economies of the European Union. Growth in GDP has accelerated in recent years, and reached 3.3% in 2006.[24]

In 2024 Austria has a very high, $59,225 nominal GDP per capita ranked 13th.[4]

Vienna was ranked the fifth richest NUTS-2 region within Europe (see Economy of the European Union), with its GDP reaching €38,632 per capita. It was trailing behind Inner London, Luxembourg, the Brussels-Capital Region and Hamburg.[25]

Growth had been steady between 2002 and 2006, varying between 1 and 3.3%.[26] After hitting 0% in 2013, growth had picked up a little. As of 2016, growth was set at 1.5%.[27]

This section needs additional citations for verification. (May 2022) |

First Austrian Republic, founded as a result of the dissolution of Austria-Hungary, inherited an economy battered by the ravages of the First World War, namely:

A number of international relief schemes failed to garner enough support[30] while a report by Sir William Goode argued that the Austrian economy would collapse without swift foreign intervention.[29] As such, the Austrian economic crisis stretched into its second year, with inflation running at 99%.[28]

Source:[30]

With annual inflation running at 2,877%,[28] the League of Nations was officially appointed to organise an Austrian reconstruction plan in August 1922. The League scheme was based on the view that Austrian troubles as a result of an inability to pay for necessities and obtain credit, and therefore, an Austrian financial revival was critical to Austrian survival. To this end, the plan was focused solely on financial reconstruction. Austria would receive loans raised from international money markets and the Austrian public, which would be secured on customs and tobacco taxes. In exchange, Austria would in effect lose sovereignty over its economy, agreeing to:

The measures took effect in 1923. Short-term effects were impressive; during the announcement to undertake Austrian reconstruction in August 1922, public confidence soared. Foreign currency holdings were converted back into krone, stabilising the currency. This allowed the Austrian Foreign Exchange Agency to finally intervene to fix the krone to the dollar, something that the wild gyrations of the past had not permitted. Capital rushed back into Austria, and domestic prices stabilised, pronouncing the end of hyperinflation.[31]

The steam ran out shortly after implementation. Growth averaged 0.35% per annum until 1929,[30] unemployment leapt five-fold,[32] bankruptcies increased 41-fold,[33] and the trade deficit doubled.[34]

Austria was annexed by Nazi Germany in 1938, and consequently lost control of its own economic policy until the formation of the Second Republic in 1945.

Ever since the end of the World War II, Austria has achieved sustained economic growth. In the soaring 1950s, the rebuilding efforts for Austria lead to an average annual growth rate of more than 5% in real terms and averaged about four-point five percent through most of the 1960s.[35] Following moderate real GDP growth of 1.7%, 2% and 1.2%, respectively, in 1995, 1996, and 1997, the economy rebounded and with real GDP expansion of 2.9 percent in 1998 and 2.2% in 1999.

Austria became a member of the EU on 1 January 1995.[36] Membership brought economic benefits and challenges and has drawn an influx of foreign investors attracted by Austria's access to the single European market. Austria also has made progress in generally increasing its international competitiveness. As a member of the economic and monetary union of the European Union (EMU), Austria's economy is closely integrated with other EU member countries, especially with Germany. On 1 January 1999, Austria introduced the new Euro currency for accounting purposes. In January 2002, Euro notes and coins were introduced, replacing those of the Austrian schilling.

In Austria, Euros appear as 1999, however all Austrian euro coins introduced in 2002 have this year on it; unlike other countries of the Eurozone where mint year is minted in the coin. Eight different designs, one per face value, were selected for the Austrian coins. In 2007, in order to adopt the new common map like the rest of the Eurozone countries, Austria changed the common side of its coins.

Before adopting the Euro in 2002 Austria had maintained use of the Austrian schilling which was first established in December 1924. The Schilling was abolished in the wake of the Anschluss in 1938 and has been reintroduced after the end of the World War II in November 1945.

Austria has one of the richest collection of collectors' coins in the Eurozone, with face value ranging from 10 to 100 euro (although a 100,000 euro coin was exceptionally minted in 2004). These coins are a legacy of an old national practice of minting of silver and gold coins. Unlike normal issues, these coins are not legal tender in all the eurozone. For instance, a €5 Austrian commemorative coin cannot be used in any other country.

Many of the country's largest firms were nationalised in the early post-war period to protect them from Soviet takeover as war reparations. For many years, the government and its state-owned industries conglomerate played a very important role in the Austrian economy. However, starting in the early 1990s, the group was broken apart, state-owned firms started to operate largely as private businesses, and a great number of these firms were wholly or partially privatised. The government still operates some firms, state monopolies, utilities, and services. In the aftermath of the financial crisis of 2007–2008 two banks were nationalised. Since 2019 the Österreichische Industrieholding (ÖBAG) administers the investments of the Republic of Austria in partially or entirely nationalized companies, but came under strong criticism after leaked messages showed how Thomas Schmidt had a say in the appointment of the supervisory board and became sole director. Austria enjoys well-developed industry, banking, transportation, services, and commercial facilities.

Austria has a strong labour movement. The Austrian Trade Union Federation (ÖGB) comprises constituent unions with a total membership of about 1.5 million—more than half the country's wage and salary earners. Since 1945, the ÖGB has pursued a moderate, consensus-oriented wage policy, cooperating with industry, agriculture, and the government on a broad range of social and economic issues in what is known as Austria's "social partnership". The ÖGB has often opposed the Schüssel government's programme for budget consolidation, social reform, and improving the business climate, and indications are rising that Austria's peaceful social climate could become more confrontational.

Austrian farms, like those of other west European mountainous countries, are small and fragmented, and production is relatively expensive. Since Austria's becoming a member of the EU in 1995, the Austrian agricultural sector has been undergoing substantial reform under the EU's Common Agricultural Policy (CAP). Although Austrian farmers provide about 80% of domestic food requirements, the agricultural contribution to gross domestic product (GDP) has declined since 1950 to less than 3%.

Although some industries are global competitors, such as several iron and steel works, chemical plants and oil corporations that are large industrial enterprises employing thousands of people, most industrial and commercial enterprises in Austria are relatively small on an international scale.

Most important for Austria is the service sector generating the vast majority of Austria's GDP. Vienna has grown into a finance and consulting metropole and has established itself as the door to the East within the last decades. Viennese law firms and banks are among the leading corporations in business with the new EU member states. Tourism is very important for Austria's economy, accounting for around 10 percent of Austria's GDP.[37] In 2001, Austria was the tenth most visited country in the world with over 18.2 million tourists. Previously, dependency on German guests made this sector of the Austrian economy very dependent on German economy. However recent developments have brought a change, especially since winter ski resorts such as Arlberg or Kitzbühel are now more and more frequented by Eastern Europeans, Russians and Americans.

Austria produced in 2018:

In addition to smaller productions of other agricultural products.[38]

This section needs expansion. You can help by adding to it. (December 2010) |

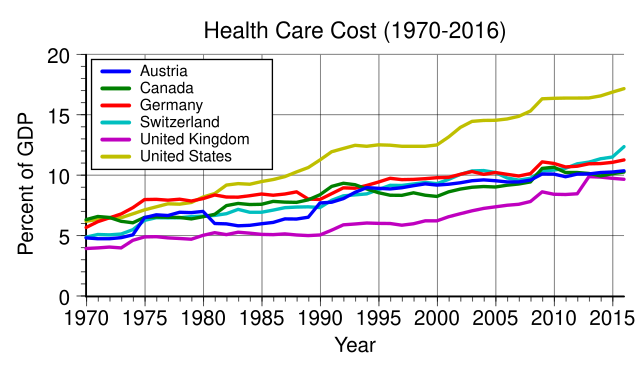

Austria's health care system was developed alongside other social welfare programmes by the social democrats in Vienna initially.[39]

Trade with other EU countries accounts for almost 66% of Austrian imports and exports. Expanding trade and investment in the emerging markets of central and eastern Europe is a major element of Austrian economic activity. Trade with these countries accounts for almost 14% of Austrian imports and exports,[40] and Austrian firms have sizable investments in and continue to move labour-intensive, low-tech production to these countries. Although the big investment boom has waned, Austria still has the potential to attract EU firms seeking convenient access to these developing markets.

The mergers and acquisitions (M&A) landscape in Austria has witnessed significant activity, with companies and investors from the country actively engaging in such transactions. Since 1991, more than 7,183 M&A deals have been announced, amounting to a known total value of 261.6 billion EUR. In 2017 alone, there were over 245 deals with a combined value exceeding 12.9 billion EUR.

Austrian companies have not only been involved in domestic M&A transactions but have also emerged as important investors in cross-border M&A ventures. Among the countries where Austrian companies have been active in M&A, Germany stands out as a particularly crucial partner. To date, Austrian parent companies have acquired 854 German companies in outbound M&A deals, highlighting the strong bilateral ties between the two nations.

When analyzing the industries that have witnessed the most M&A activity in Austria, the financial sector emerges as a prominent player in terms of transaction value. The financial industry has been the focus of significant M&A deals, with companies in this sector exploring opportunities to strengthen their market positions, expand their product portfolios, and enhance their capabilities.

On the other hand, when considering the number of transactions, the Industrials sector takes the lead, representing approximately 19.2% of the total M&A deals in Austria. This sector encompasses a wide range of industries, including manufacturing, engineering, construction, and transportation, among others. The strong presence of M&A activity in the Industrials sector signifies the ongoing interest in consolidating businesses, driving synergies, and fostering growth through strategic partnerships and acquisitions.

The M&A landscape in Austria continues to evolve, influenced by various factors such as market dynamics, economic conditions, and global trends. As companies seek opportunities for expansion, diversification, and innovation, M&A transactions will remain a strategic tool for achieving their business objectives. The financial sector and the Industrials sector are likely to remain at the forefront of M&A activity, demonstrating the vibrancy and potential for further growth in these industries.

The following table shows the main economic indicators in 1980–2021 (with IMF staff estimtates in 2022–2027). Inflation under 5% is in green.[41]

| Year | GDP

(in Bil. US$PPP) |

GDP per capita

(in US$ PPP) |

GDP

(in Bil. US$nominal) |

GDP per capita

(in US$ nominal) |

GDP growth

(real) |

Inflation rate

(in %) |

Unemployment

(in %) |

Government debt

(in % of GDP) |

|---|---|---|---|---|---|---|---|---|

| 1980 | 84.7 | 11,227.0 | 80.9 | 10,732.0 | 1.6% | n/a | ||

| 1981 | n/a | |||||||

| 1982 | n/a | |||||||

| 1983 | n/a | |||||||

| 1984 | n/a | |||||||

| 1985 | n/a | |||||||

| 1986 | n/a | |||||||

| 1987 | n/a | |||||||

| 1988 | 57.4% | |||||||

| 1989 | ||||||||

| 1990 | ||||||||

| 1991 | ||||||||

| 1992 | ||||||||

| 1993 | ||||||||

| 1994 | ||||||||

| 1995 | ||||||||

| 1996 | ||||||||

| 1997 | ||||||||

| 1998 | ||||||||

| 1999 | ||||||||

| 2000 | ||||||||

| 2001 | ||||||||

| 2002 | ||||||||

| 2003 | ||||||||

| 2004 | ||||||||

| 2005 | ||||||||

| 2006 | ||||||||

| 2007 | ||||||||

| 2008 | ||||||||

| 2009 | ||||||||

| 2010 | ||||||||

| 2011 | ||||||||

| 2012 | ||||||||

| 2013 | ||||||||

| 2014 | ||||||||

| 2015 | ||||||||

| 2016 | ||||||||

| 2017 | ||||||||

| 2018 | ||||||||

| 2019 | ||||||||

| 2020 | ||||||||

| 2021 | ||||||||

| 2022 | ||||||||

| 2023 | ||||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 |

In 2022, the sector with the highest number of companies registered in Austria is Services with 97,733 companies followed by Finance, Insurance, and Real Estate and Retail Trade with 70,696 and 59,942 companies respectively.[42]

Seamless Wikipedia browsing. On steroids.

Every time you click a link to Wikipedia, Wiktionary or Wikiquote in your browser's search results, it will show the modern Wikiwand interface.

Wikiwand extension is a five stars, simple, with minimum permission required to keep your browsing private, safe and transparent.