Insurance

equitable transfer of the risk of a loss, from one entity to another in exchange for payment From Wikipedia, the free encyclopedia

Insurance is a term in law and economics. It is something people buy to protect themselves from losing money. People who buy insurance pay a "premium" (often paid every month) and promise to be careful (a "duty of care"). In exchange for this, if something bad happens to the person or thing that is insured, the company that sold the insurance will pay the money back. (However, there are some times when the company will not have to pay the money back, such as if the person was not careful.)

This article uses too much jargon, which needs explaining or simplifying. (February 2024) |

Types of insurance

There are different kinds of insurance. There are life insurance and general insurance.

In life insurance, someone ensures their life or someone else's life. At the death of the insured person or on the date of maturity whichever happens earlier, the amount insured will be paid.

General insurance is a non-life policy, such as:

- fire insurance

- marine insurance

- travel insurance[1]

- home insurance[2]

- car insurance[3]

- commercial insurance

- business insurance[4]

- Cyber Insurance[5]

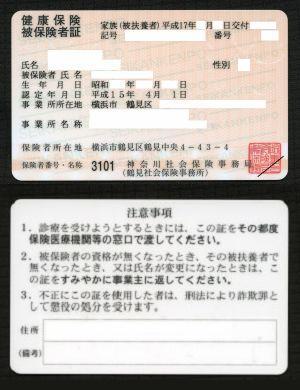

- Health insurance

Actuaries

Actuaries are the people who figure out how much the premium should be, forecast trends, evaluate the cost impact of medical programs, design and price new products, assist in designing formulary models, and forecast the impact of risk adjustment on revenues. They balance how much the insurer might have to pay out against the chances of having to pay out. If actuaries think there is a big chance that the company will have to pay out, they will make the premium higher.

References

Wikiwand - on

Seamless Wikipedia browsing. On steroids.