Top Qs

Timeline

Chat

Perspective

Revenue Act of 1926

Act of the United States Congress From Wikipedia, the free encyclopedia

Remove ads

The United States Revenue Act of 1926, 44 Stat. 9, reduced inheritance and personal income taxes, cancelled many excise imposts, eliminated the gift tax and ended public access to federal income tax returns.

The most notable parts of the Act were that maximum tax rates on inheritances and large estates were halved, as were income taxes for the wealthiest. As a consequence, taxes on the wealthy were greatly reduced.[1] To garner political support for such massive tax cuts for the wealthy, the Act also provided small tax cuts across the board.[1]

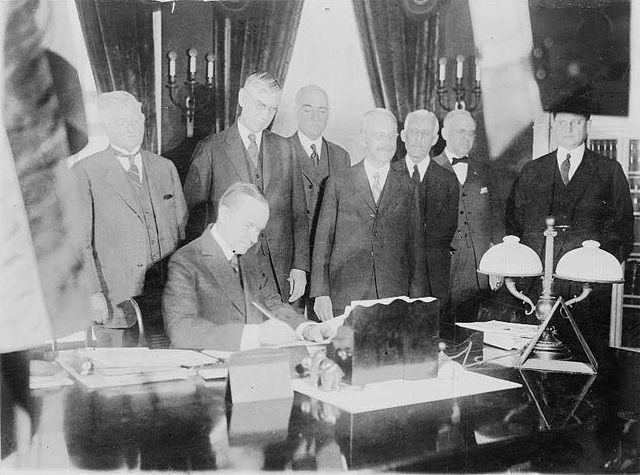

Passed by the 69th Congress, it was signed into law by President Calvin Coolidge.

The act was applicable to incomes for 1925 and thereafter.[2]

Remove ads

Tax on Corporations

A rate of 13.5 percent was levied on the net income of corporations.

Tax on individuals

A normal tax and a surtax were levied against the net income of individuals as shown in the following table.

- Exemption of $1,500 for single filers and $3,500 for married couples and heads of family. A $400 exemption for each dependent under 18.

Remove ads

References

Wikiwand - on

Seamless Wikipedia browsing. On steroids.

Remove ads