Top Qs

Timeline

Chat

Perspective

Consumption function

Economic model relating consumption and disposable income From Wikipedia, the free encyclopedia

Remove ads

In economics, the consumption function describes a relationship between consumption and disposable income.[1][2] The concept is believed to have been introduced into macroeconomics by John Maynard Keynes in 1936, who used it to develop the notion of a government spending multiplier.[3]

Remove ads

Details

Summarize

Perspective

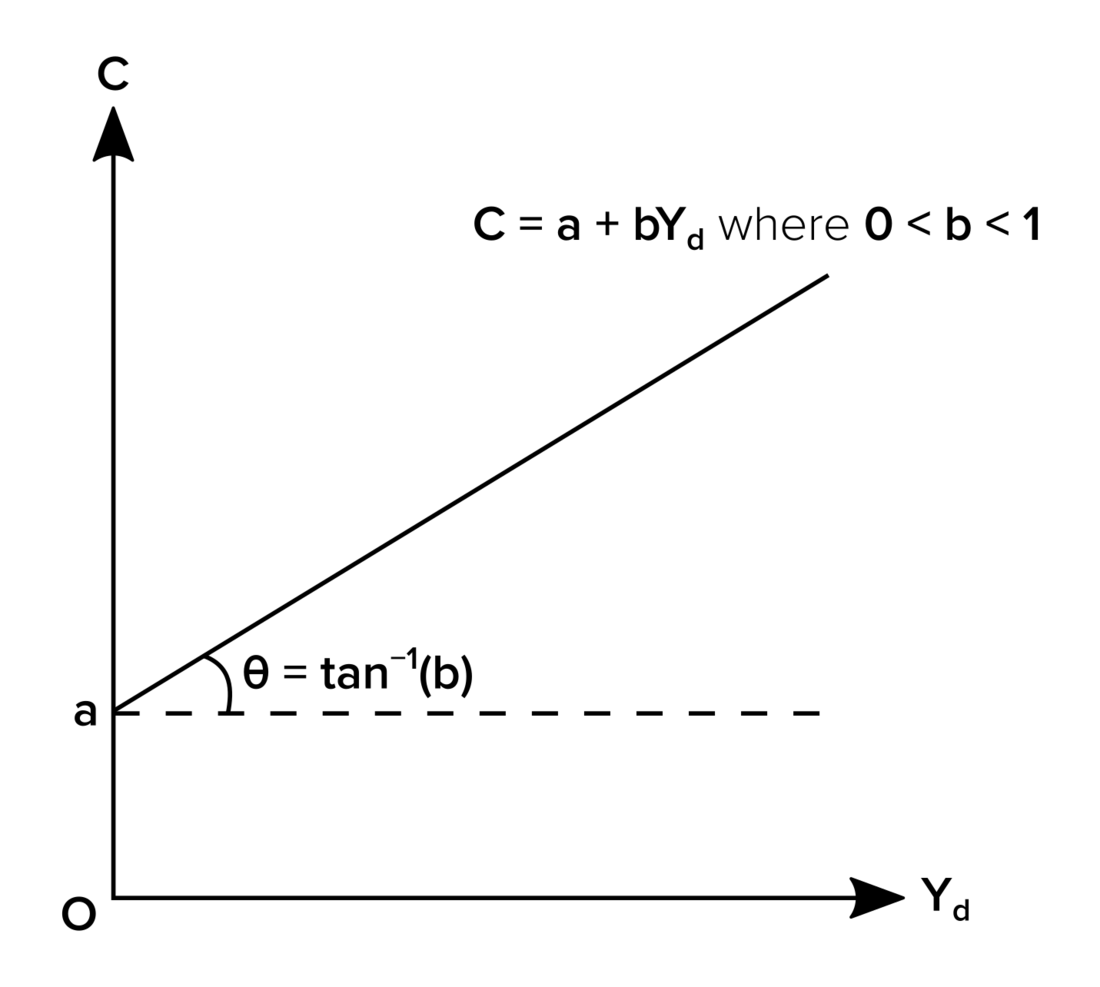

Its simplest form is the linear consumption function used frequently in simple Keynesian models:[4]

where is the autonomous consumption that is independent of disposable income; in other words, consumption when disposable income is zero. The term is the induced consumption that is influenced by the economy's income level . The parameter is known as the marginal propensity to consume, i.e. the increase in consumption due to an incremental increase in disposable income, since . Geometrically, is the slope of the consumption function.

Keynes proposed this model to fit three stylized facts:[5]

- People typically spend a part, but not all of their income on consumption, and they save the rest. They typically do not borrow money to spend, or borrow money to save.[6] This fact is modelled by requiring .

- People with higher income save a higher proportion of the income. This is modelled by decreasing with .

- People, when deciding how much to save, are insensitive to the interest rate.[6]

By basing his model in how typical households decide how much to save and spend, Keynes was informally using a microfoundation approach to the macroeconomics of saving.[7]

Keynes also took note of the tendency for the marginal propensity to consume to decrease as income increases, i.e. .[8] If this assumption is to be used, it would result in a nonlinear consumption function with a diminishing slope. Further theories on the shape of the consumption function include James Duesenberry's (1949) relative consumption expenditure,[9] Franco Modigliani and Richard Brumberg's (1954) life-cycle hypothesis, and Milton Friedman's (1957) permanent income hypothesis.[10]

Some new theoretical works following Duesenberry's and based in behavioral economics suggest that a number of behavioural principles can be taken as microeconomic foundations for a behaviorally-based aggregate consumption function.[11]

Remove ads

See also

Notes

Further reading

External links

Wikiwand - on

Seamless Wikipedia browsing. On steroids.

Remove ads