Phenomenon when shorter term bonds yield higher interest rates than longer term bonds From Wikipedia, the free encyclopedia

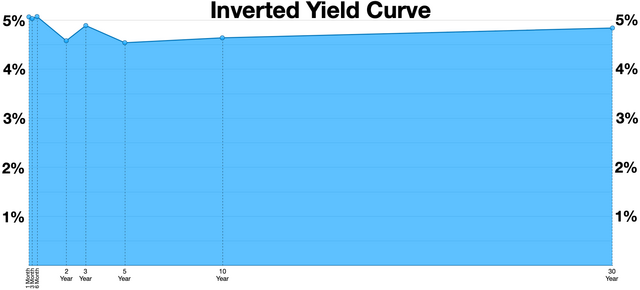

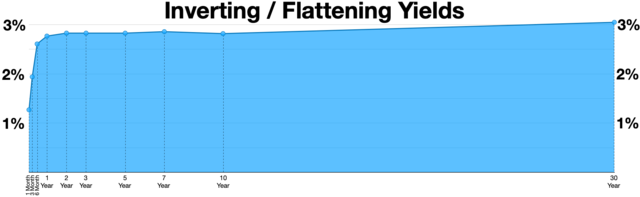

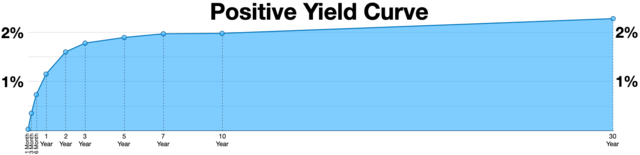

In finance, an inverted yield curve is a yield curve in which short-term debt instruments (typically bonds) have a greater yield than longer term bonds. An inverted yield curve is an unusual phenomenon; bonds with shorter maturities generally provide lower yields than longer term bonds.[2][3]

To determine whether the yield curve is inverted, it is a common practice to compare the yield on the 10-year U.S. Treasury bond to either a 2-year Treasury note or a 3-month Treasury bill. If the 10-year yield is less than the 2-year or 3-month yield, the curve is inverted.[4][5][6][7]

The term "inverted yield curve" was coined by the Canadian economist Campbell Harvey in his 1986 PhD thesis at the University of Chicago.[8]

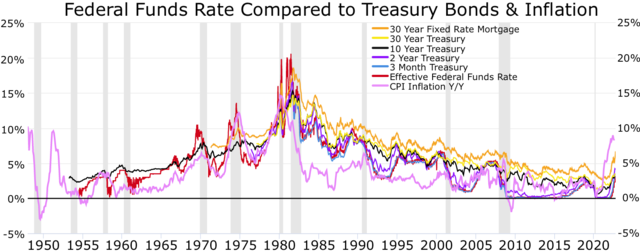

There are several explanations of why the yield curve becomes inverted. The "expectations theory" holds that long-term rates depicted in the yield curve are a reflection of expected future short-term rates,[9] which in turn reflect expectations about future economic conditions and monetary policy. In this view, an inverted yield curve implies that investors expect lower interest rates at some point in the future – for example, when the economy is expected to enter a recession and the Federal Reserve reduces interest rates to stimulate the economy and pull it out of recession. In that scenario, expected future short-term rates fall below current short-term rates, and the yield curve inverts.[10][11]

A related explanation holds that when investors who value interest income expect recession, a shift in Federal Reserve policy and lower interest rates, they try to lock in long-term yields to protect their income stream. The resulting demand for longer-term bonds drives up their prices, reducing long-term yields.[11]: 87

The inverted yield curve is the contraction phase in the Business cycle or Credit cycle when the federal funds rate and treasury interest rates are high to create a hard or soft landing in the cycle. When the Federal funds rate and interest rates are lowered after the economic contraction (to get price and commodity stabilization) this is the growth and expansion phase in the business cycle. The Federal Reserve only indirectly controls the money supply and it is the banks themselves that create new money when they make loans (Debt based monetary system). By manipulating interest rates with the Federal funds rate and Repurchase agreement (Repo Market) the Fed tries to control how much new money banks create.[12][13]

It has often been said that the inverted yield curve has been one of the most reliable leading indicators for economic recession during the post–World War II era. Proponents of this position maintain that inversion tends to predate a recession 7 to 24 months in advance.[2]: 318 [10][14][15][16][17] Others are skeptical, for example stating that the inverted yield curve is "not necessarily" a reliable metric for predicting recession, or that it has predicted "nine of the past five" recessions.[11]: 86 [18]

In 2023, inversion during a labor shortage and low indebtedness raised questions over whether widespread awareness of its predictive power made it less predictive.[19]

The longest and deepest Treasury yield curve inversion in history began in July 2022, as the Federal Reserve sharply increased the fed funds rate to combat the 2021–2023 inflation surge. Despite widespread predictions by economists and market analysts of an imminent recession, none had materialized by July 2024, economic growth remained steady, and a Reuters survey of economists that month found they expected the economy to continue growing for the next two years. An earlier survey of bond market strategists found a majority no longer believed an inverted curve to be a reliable recession predictor. The curve began re-steepening toward positive territory in June 2024, as it had at other points during that inversion; in every previous inversion they examined, Deutsche Bank analysts found the curve had re-steepened before a recession began.[20][21][22]

German bonds Inverted yield curve in 2008 and Negative interest rates 2014–2022

30 year

10 year

2 year

1 year

3 month

|

50 year

20 year

10 year

2 year

1 year

3 month

1 month

|

30 year

10 year

2 year

1 year

3 month

1 month

|

30 year bond

10 year bond

5 year bond

1 year bond

3 month bond

|

15 year bond

10 year bond

5 year bond

3 year bond

|

20 year bond

10 year bond

1 year bond

3 month bond

|

Inverted yield curve in the first half of 2022 during Sri Lankan economic crisis 15 year bonds

10 year bonds

5 year bonds

1 year bonds

6 month bonds

|

10 year bond

5 year bond

1 year bond

|

10 year bonds

5 year bonds

2 year bonds

|

Inverted yield curve in 1990 Zero interest-rate policy starting in 1999[24] Negative interest rate policy started in 2014 30 year

20 year

10 year

5 year

2 year

1 year

|

Inverted yield curve in 1994–1998 and 2004–2008 20 year

10 year

2 year

3 month

1 month

|

Seamless Wikipedia browsing. On steroids.