Islamic taxes

Taxes sanctioned by Islamic law From Wikipedia, the free encyclopedia

Islamic taxes are taxes sanctioned by Islamic law.[1] They are based on both "the legal status of taxable land" and on "the communal or religious status of the taxpayer".[1]

Islamic taxes include

- zakat - one of the five pillars of Islam. Only imposed on Muslims, it is generally described as a 2.5% tax on savings for charity. As stated in the Quran 9:60, "Indeed, [prescribed] charitable offerings are only [to be given] to the poor and the indigent, and to those who work on [administering] it, and to those whose hearts are to be reconciled, and to [free] those in bondage, and to the debt-ridden, and for the cause of God, and to the wayfarer. [This is] an obligation from God. And God is all-knowing, all-wise." Outlined in this verse are the 8 categories where Zakat is eligible.[2]

- jizya - a per capita yearly tax historically levied by Islamic states on certain non-Muslim subjects—dhimmis—permanently residing in Muslim lands under Islamic law, the tax excluded the poor, women, children and the elderly.[1][3][4][5] (see below)

- kharaj - a land tax initially imposed only on non-Muslims but soon after mandated for Muslims as well.[1]

- ushr - a 10% tax on the harvests of irrigated land and 10% tax on harvest from rain-watered land and 5% on Land dependent on well water.[6] The term has also been used for a 10% tax on merchandise imported from states that taxed the Muslims on their products.[7] Caliph `Umar ibn Al-Khattāb was the first Muslim ruler to levy ushr.[citation needed]

- khums (Arabic: خُمْس Arabic pronunciation: [xums]) a tax of one-fifth (20%) of wealth acquired as the spoils of war; and, according to most Muslim jurists, other specified types of income, towards various designated beneficiaries.[8] In Islamic legal terminology, "spoils of war" (al-ghanima) refers to property and wealth looted by the Muslim army after battling with or raiding non-Muslims.[9]

The taxes stipulated by Islamic law generally did not generate enough revenue even for the limited expenditures made by pre-modern governments, and rulers were forced to impose additional taxes, which were condemned by the ulema.[10]

According to scholar Murat Çizakça, only zakat, jizya and kharaj are mentioned in the Buktasira.[11][clarification needed]

Ushr

Summarize

Perspective

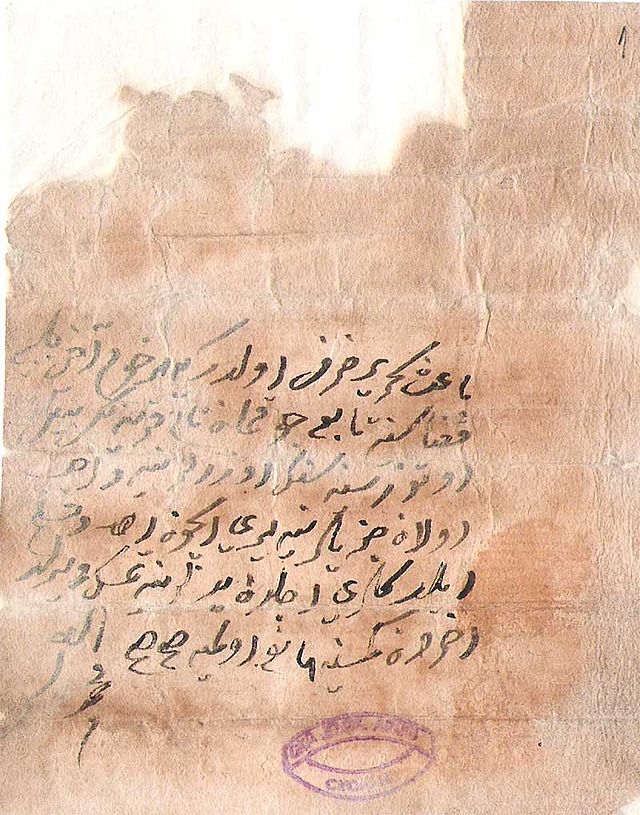

Ushur or ushr (Arabic: عشر), in Islam, is 10 percent for irrigated lands or 10 percent for non-irrigated lands levy on agriculture produce. Caliph Umar expanded the scope of ushr to include border trade tax.[12] It literally means a tenth part,[13] and it remained in practice in Islamic ruled territories from Spain and North Africa through India and Southeast Asia through the 18th century.[14] Ushur was applied on traders, at a rate of 10% of the value of the merchandise that was either imported or exported across the border controlled by the Islamic state. It applied to non-Muslim traders as well, who were residents of the Islamic state (dhimmi), as well as to non-Muslim traders who were foreigners and wished to sell their merchandise inside the Islamic state.[12] Historical medieval era trade documents between Oman and India, refer to this tax on ships arriving at trade port as ashur or ushur.[15] Ushr and Jizya would grant non-Muslims a privilege in war time, i.e. non-Muslims could not be obliged to join in military activities, in case, there was a war. By paying taxes, non-Muslims were protected by the Islamic law from any harm (dhimmi- the protected one), as opposed to, Muslims had to pay Zakah as well as were obliged to join in military activities in order to protect Muslims and non-Muslims alike.[16]

References

Wikiwand - on

Seamless Wikipedia browsing. On steroids.