Banca Nazionale del Lavoro

Italian bank From Wikipedia, the free encyclopedia

Banca Nazionale del Lavoro S.p.A. (BNL) is an Italian bank headquartered in Rome. It is Italy's sixth largest bank,[1] and has been a subsidiary of BNP Paribas since 2006. Integration process was concluded in 2008, BNL with its group oversees the commercial banking activity in Italy.[2]

This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these messages)

|

| |

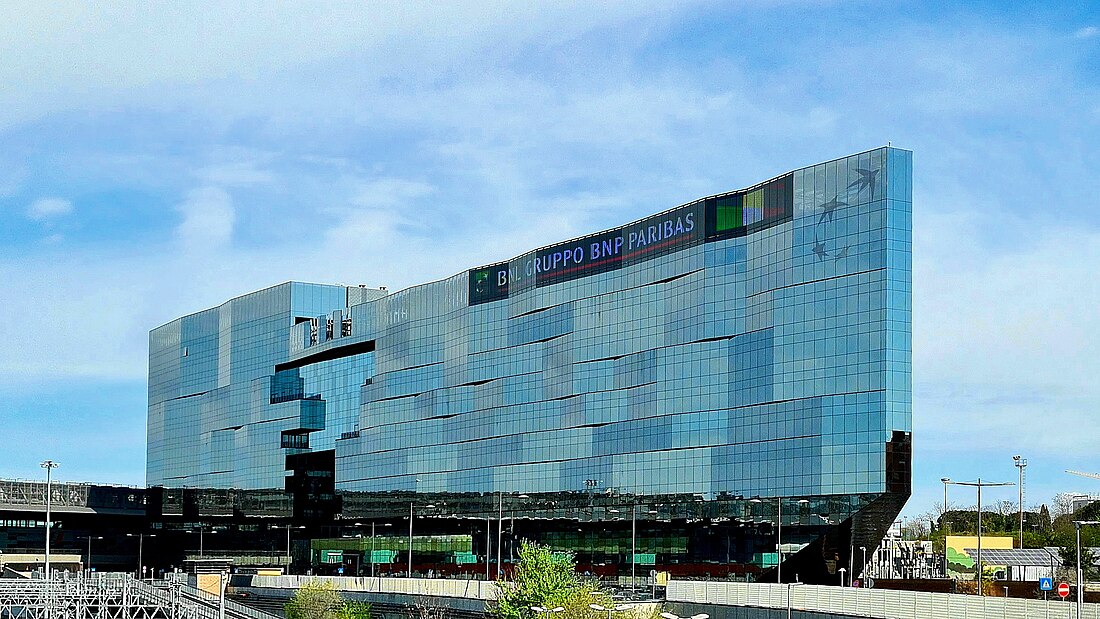

Headquarters of BNL in Rome | |

| Company type |

|

|---|---|

| Industry | Banking Financial services |

| Founded | 1913 (as Istituto Nazionale di Credito per la Cooperazione) |

| Headquarters | Rome, Italy |

Area served | Italy |

Key people | Claudia Cattani (Chairwoman) Elena Goitini (CEO) |

Number of employees | 19,000 (2014) |

| Parent | BNP Paribas |

| Website | www |

History

Summarize

Perspective

You can help expand this article with text translated from the corresponding article in Italian. (November 2017) Click [show] for important translation instructions.

|

Founded in 1913 as Istituto Nazionale di Credito per la Cooperazione, it was nationalized in 1929. It was re-privatized and listed on the Milan Stock Exchange in 1998, before being acquired by French banking group BNP Paribas in 2006.

Banca Nazionale del Lavoro began Argentine operations in 1960, ultimately opening 91 branches, before selling its operation there to HSBC Bank Argentina in 2006.[citation needed]

In 2016 the company opened a contemporary all glass building for its headquarters: BNL BNP Paribas headquarters.[3]

Scandals

The bank was involved in a major political scandal (dubbed Iraqgate by the media) when it was revealed in 1989 that the Atlanta, Georgia, branch of the bank was making unauthorized loans of more than US$4.5 billion to Iraq. Many of the loans that the branch made were guaranteed by the United States Department of Agriculture's Commodity Credit Corporation program. The loans were originally intended to finance agricultural exports to Iraq, but were diverted by Iraq to buy weapons. The branch manager, Christopher Drogoul, indicated that the bank's headquarters office was aware of these loans, but senior bank official denied this. Drogoul pleaded guilty to three felony charges and served 33 months in federal prison.[4]

Ownership

At the year end of 2004 the major shareholders with more than 2% were:[5]

- BBVA 14.75190%

- Assicurazioni Generali 8.71980%

- Diego Della Valle (Dorint Holding S.A.) 4.99436%

- Stefano Ricucci Trust (Magiste International S.A.) 4.98985%

- Francesco Gaetano Caltagirone 4.96904%

- Danilo Coppola (PACOP SpA) 4.92611%

- Banca Monte dei Paschi di Siena 4.41788%

- Giuseppe Statuto (Michele Amari Srl) 4.09248%

- Banca Popolare di Vicenza 3.63682%

- Vito Bonsignore (Gefip Holding SpA) 3.07572%

After a short period of Unipol minority ownership as well as the exposed bancopoli scandal, BNP Paribas signed an agreement with 13 shareholders of BNL, representing 48% shares of BNL on 6 February 2006. BNP Paribas also made offer to buy all the remain shares from the public and delisted the company from Borsa Italiana.[6] MPS sold the shares to Deutsche Bank instead.[7]

Gallery

See also

References

External links

Wikiwand - on

Seamless Wikipedia browsing. On steroids.